Why the world will move to debt funds that are specific to an industry...

Controversial push on leveraged loans extends regulators’ reach beyond banks and across entire financial system

Federal Reserve official Todd Vermilyea left no doubt about what regulators thought of a risky-looking type of loan made to companies when he spoke at a banking conference last year. “No, no, no, no, no,” said Mr. Vermilyea, a senior associate director at the Fed.

What happened after that shows how relentless pressure from regulators is forcing banks to do business differently in the wake of the financial crisis.

Leveraged loans, which go to companies already deep in debt, fell about 20% in dollar volume through October from the same period last year. And underwriting standards on those loans have improved in the past year, according to a recent report by three federal banking agencies.

“We learned a lesson” from the financial crisis, says one former regulator who pushed for a crackdown when leveraged loans surged in 2013 and standards slipped. “You can’t wait.”

Regulators and banks have clashed repeatedly over how to best shield the financial system from the next crisis. The leveraged loan battle has been one of the thorniest because regulators extended their reach beyond individual banks and across the entire financial system.

Banks also objected because their primary role in leveraged loans is as middlemen who arrange a loan and sell it in pieces to outside investors. The banks bear less risk if the borrower defaults than if they held on to the loans.

Hefty profits

Leveraged loans generate hefty profits for banks such as Credit Suisse Group AG and J.P. Morgan Chase & Co. Borrowers include Wendy’s International Inc., SeaWorld Entertainment Inc. and PetSmart Inc.

While leveraged loans didn’t cause the financial crisis, their postcrisis boom alarmed regulators who saw an eerie parallel to the mortgage bonds that battered investors world-wide during the foreclosure epidemic.

“Our banks are completely tied to the broader financial system in some form or fashion, so if there is weakness in one part of the system, it is likely going to have negative consequences for the banks,” says Darrin Benhart, the Office of the Comptroller of the Currency’s deputy comptroller for supervision risk management.

In response, the Fed, OCC and Federal Deposit Insurance Corp. strong-armed U.S. banks for the first time ever to comply with minimum underwriting standards on leveraged loans no matter who shoulders the credit risk.

The heightened scrutiny has included monthly reviews of individual banks’ leveraged loan portfolios. Regulators also have lowered the boom on some lenders in so-called private letters, for which failure to comply can lead to fines or curbs on lending, dividends and other activities.

Last year, the U.S. units of Switzerland’s Credit Suisse and Germany’s Deutsche Bank AG got letters demanding “immediate attention” to their leveraged loan portfolios, people familiar with the matter say. The banks declined to comment.

Many bankers say the government is overreacting and could make it harder for companies to borrow when they need to. “The unintended consequence may be that this restricts access to credit in a downturn,” says Chuck McMullan, a senior managing director of investment bank Evercore Partners Inc. ’s debt advisory group.

The crackdown also has encouraged companies to take their leveraged loan business to firms that aren’t regulated by the Fed and OCC, such as Leucadia National Corp. ’s Jefferies Group LLC and Nomura Holdings Inc. of Japan.

In the second quarter, financial firms that aren’t overseen by the Fed or OCC took the lead role in arranging 8% of all leveraged loans by volume, up from 3.8% a year earlier, according to S&P Capital IQ LCD, part of McGraw Hill Financial Inc. Regulators say the shift needs to be monitored but doesn’t seem to pose a threat to financial stability.

Still, the consensus among even government officials is uneasy. Jerome Powell, a Fed governor who helps set regulatory policy and previously was a partner at private-equity firm Carlyle GroupLP, said in a February speech that regulators were justified in their actions but should be careful about interfering with willing buyers and sellers in the capital markets.

”Financial stability need not seek to eliminate all risks,” Mr. Powell said. “We need to learn, but not overlearn, the lessons of the crisis.”

As of Oct. 31, leveraged loan volume totaled $382.3 billion so far this year, down 21% from the same period in 2014, according to S&P Capital IQ LCD. Loans to fund leveraged buyouts, in which a small group of investors uses borrowed money to purchase a company, fell 11% to $67.7 billion.

Government red tape isn’t the only reason for those declines. The recent collapse in commodities prices led some banks to reduce their exposure to energy companies, which tend to be major leveraged loan borrowers.

Some private-equity firms are doing fewer takeovers with loans because the stock prices of potential targets are too high. Meanwhile, demand from some loan investors has slackened.

In some ways, the reining in of leveraged loans goes all the way back to 2006, when the Fed, OCC, and FDIC cautioned that they had noticed “increasing credit risk” in a rapidly growing part of bank loan portfolios.

Companies were borrowing more relative to their earnings. Private-equity firms used more debt to finance corporate takeovers. Banks backed deals that included fewer protections for lenders if the borrower’s finances deteriorated.

Lenders largely ignored the warning. According to S&P Capital IQ LCD, leveraged loan volume reached a then-record $534.8 billion in 2007 as banks bundled the loans into securities and sold them to investors.

“As long as the music is playing, you’ve got to get up and dance,” Charles Prince, then chief executive of Citigroup Inc., told the Financial Times in a reference to the market for corporate buyouts by private-equity firms. Those takeovers poured fuel on the leveraged loan business.

But demand dried up when the financial crisis erupted. Citigroup suffered losses of $5 billion on its leveraged loan portfolio from mid-2007 to mid-2008. Across the industry, large lenders got stuck with more than $300 billion of leveraged loans and commitments they couldn’t sell.

Regulators disagreed

By 2012, though, leveraged loans were bouncing back. Low interest rates and profit-hungry investors pushed total loan volume to $465.5 billion.

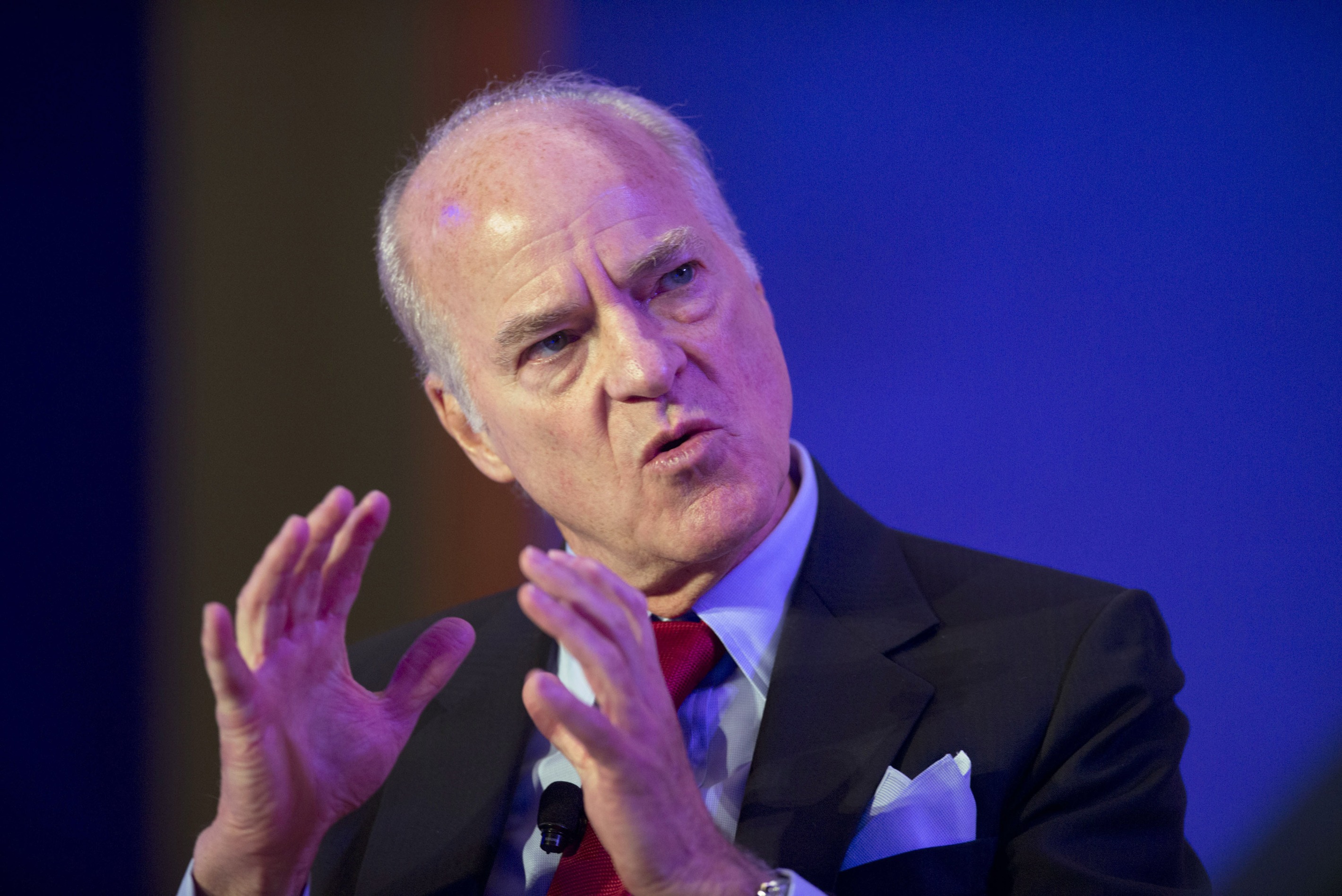

U.S. Bancorp’s Richard Davis said regulators started ‘auditing hard’ after the government announced tougher scrutiny of leveraged loans. Photo: Jerry Holt/Minneapolis Star Tribune/Zuma Press

Some veteran regulators, including at the Fed, wanted to issue general guidelines and leave lending decisions up to the market, say people who participated in the discussions. If banks were selling the loans to willing investors, these regulators thought, then federal agencies shouldn’t intervene.

Other regulators were adamant about the need for a single, specific underwriting standard for all loans. They recalled how the Fed, OCC, and FDIC had published joint guidelines for risky mortgages in 2006 and 2007, but that was too late to ameliorate or avert the housing crash.

Single-standard proponents included members of the OCC’s influential National Risk Committee. The Fed’s new head of banking supervision and regulation, Michael Gibson, also endorsed the approach, and it prevailed.

New lending guidelines issued in March 2013 directed banks to follow the same underwriting standards regardless of whether they were holding loans or selling them. The guidelines detailed how banks should identify risky loans, evaluate a borrower’s ability to repay and make sure the bank had adequate protections in place in case of default.

Regulators were explicit about loan characteristics that would grab their attention, such as lax repayment time lines and the absence of loan covenants. Any loan that left a company with debt exceeding six times its earnings before interest, taxes, depreciation and amortization, known as Ebitda, “raises concerns for most industries,” regulators wrote in the guidelines.

Lenders seemed to shrug—and kept on making leveraged loans. Volume set a record high in 2013, surging to $607.1 billion. Nearly one in three large, corporate LBOs failed the Ebitda test specified by regulators, according to S&P Capital IQ LCD.

Starting in late summer, roughly a dozen big banks received a “Matters Requiring Attention” letter from the OCC and the Fed. The letters chided the banks for putting the financial system at risk because of lax and inadequate application of the leveraged loan guidelines, regulators claimed.

Regulators “came and started auditing for it—and I mean auditing hard, every one of us,” U.S. Bancorp Chairman, President and Chief Executive Richard Davis said at a conference in November 2013. The Minneapolis bank isn’t a major participant in the leveraged loan market and didn’t get a letter.

Some banks buckled to the pressure but complained that rivals kept doing business as usual.

Holdouts often claimed that many of their loan deals were made before the regulatory warning, while other lenders said the guidelines weren’t clear or were being interpreted differently by the Fed and OCC.

At the OCC, the task of bringing banks in line fell to Martin Pfinsgraff, who worked on leveraged loans while an executive at Prudential Financial Inc. and came to the OCC after the financial crisis. Mr. Pfinsgraff, senior deputy comptroller for large bank supervision, favored a “no exceptions” approach, meaning banks should never make a leveraged loan that fell outside the standards.

But Fed officials told lenders that they were willing to agree to disagree on individual loans, as long as banks judged deals in a way that met the Fed’s expectations. Some bankers saw that as granting them a handful of free passes.

In January 2014, Carlyle announced a $4.15 billion buyout of Johnson & Johnson ’s blood-testing unit, one of the largest deals that year. Bank of America Corp. and J.P. Morgan, both overseen by the OCC, sat out the deal.

Barclays PLC, Goldman Sachs Group Inc. and UBS Group AG, all supervised by the Fed, were among the lenders that funded the buyout. They declined to comment. Carlyle also declined to comment.

Senior officials at the Fed became convinced that they needed to speak out, partly to clarify the perception of a discrepancy between the two agencies. Fed Chairwoman Janet Yellen directed officials to step up their enforcement of the guidelines, and they sent Mr. Vermilyea to the conference in Charlotte, N.C., to deliver his warning.

In July 2014, Ms. Yellen called out “pockets of increased risk-taking across the financial system,” including leveraged loans. In a speech, she said the loans didn’t pose a “systemic threat” but added that the Fed was ready to act.

The warning letters to banks made it clear that regulators weren’t about to back down. Less than a day after The Wall Street Journal reported that Credit Suisse got a letter, the bank pulled out of deals, including private-equity firm Hellman & Friedman’s acquisition of Grocery Outlet Inc.

Until that point last year, Credit Suisse had arranged or sold about $53.8 billion of leveraged loans marketed to U.S. investors in 2014, giving the Swiss bank a market share of 6.5% and about $702 million in fees, Dealogic estimated. Credit Suisse declined to comment.

In late 2014, Mr. Pfinsgraff and Timothy Clark, a senior associate director in the Fed’s bank oversight division, met with chief risk officers of Wall Street financial firms at the Pierre Hotel in New York City to make sure the message was loud and clear.

“We got read the riot act,” says one banker who was there. “You’ve got to change behavior.”

At the recent pace, leveraged loan volume this year would shrink to $459 billion in 2015, the lowest total since 2011, according to S&P Capital IQ LCD.

In a report last month, the Fed, OCC and FDIC said banks “are making progress,” though many leveraged loans still raise concerns about the borrowers’ ability to repay.

The regulators have begun to worry about something else: loans to energy companies that might be in trouble because of volatile fuel prices.

By Ryan Tracy - WSJ